Compliance

Don’t get left behind. Ensure fleet and regulatory compliance with Geotab.

Services

DOT Compliance Electronic Logging Device (ELD)

Strengthen DOT compliance, safety and more with Geotab ELD. Stay in the know and minimize violations with dashboard reports on driver status and real-time alerts. Geotab’s fleet compliance solution also simplifies compliance for drivers with step-by-step workflows and pop-up reminders.

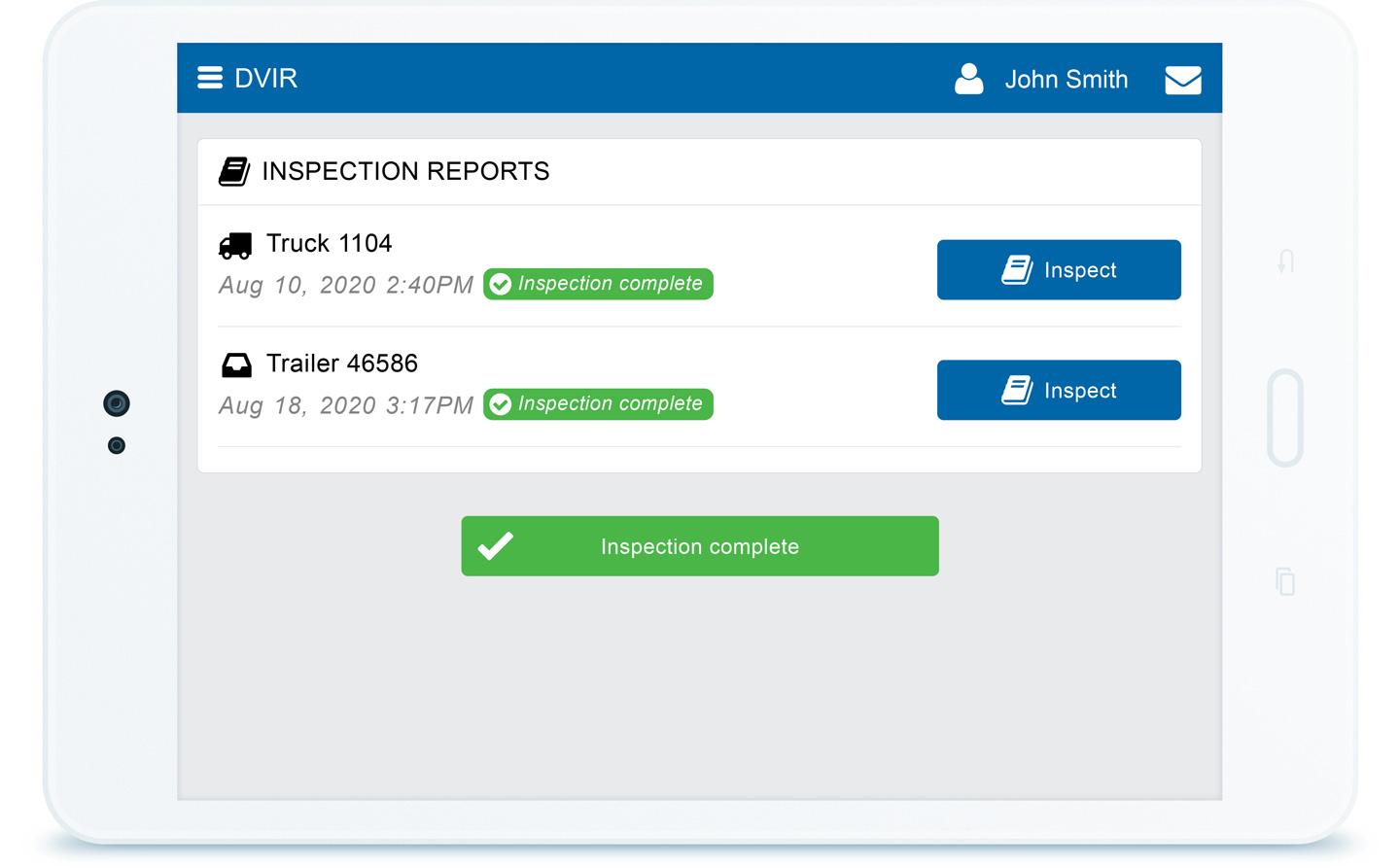

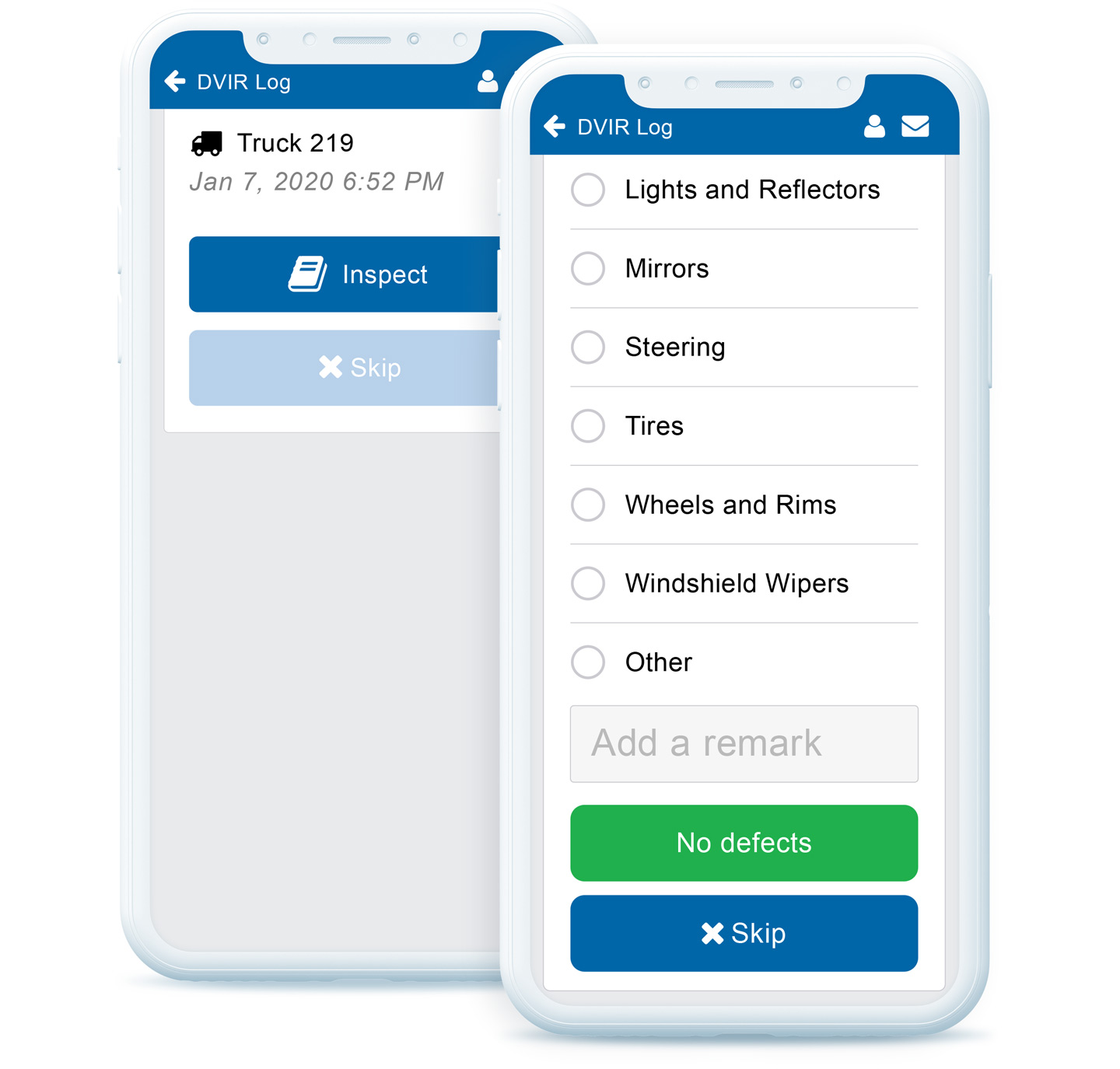

Compliance Management – Driver Vehicle Inspection Report (DVIR)

Simplify compliance management and save time on Driver Vehicle Inspection Reporting (DVIR) with the Geotab Drive Mobile App. Complete pre-trip and post-trip inspections right from a smartphone or tablet.

What Is DVIR?

A Driver Vehicle Inspection Report (DVIR) is a formal report which confirms that a driver has completed an inspection on a commercial motor vehicle. Drivers must complete pre-trip and post-trip inspections and detail any mechanical defects they encounter. These inspections play an important part in improving road safety while ensuring fleet compliance.

Why is DVIR Needed?

DVIRs are enforced by authorities in the U.S. with the aim of increasing safety by reducing the number of collisions, injuries and fatalities involving commercial vehicles. An Electronic DVIR helps improve road safety by enforcing vehicle inspections before and after every trip.

Penalties For Not Completing An Inspection

Motor Carrier Safety Assistance Program (MCSAP) Inspectors are responsible for completing roadside inspections on commercial motor vehicles and drivers. Noncompliance to DVIR regulations may result in fines given at the discretion of the Department of Transportation (DOT) officer. Vehicles which are deemed unsafe during a roadside inspection will be out of commission effective immediately. This unplanned downtime could create a loss in revenue to the carrier.

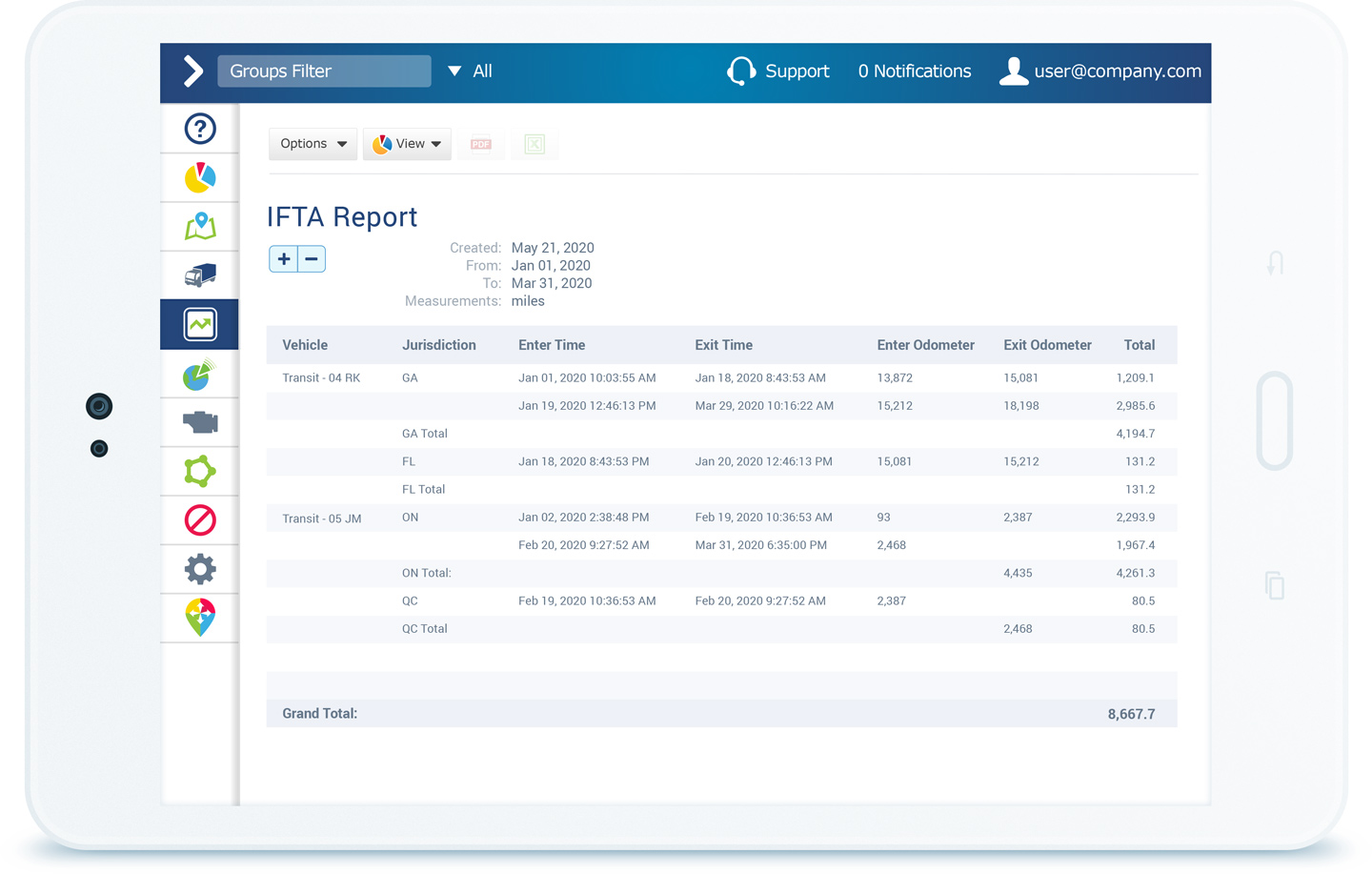

Fleet Compliance – International Fuel Tax Agreement (IFTA)

Streamline the process of IFTA management with telematics. Track miles by state or province for each fleet vehicle and get accurate entry and exit odometer readings.

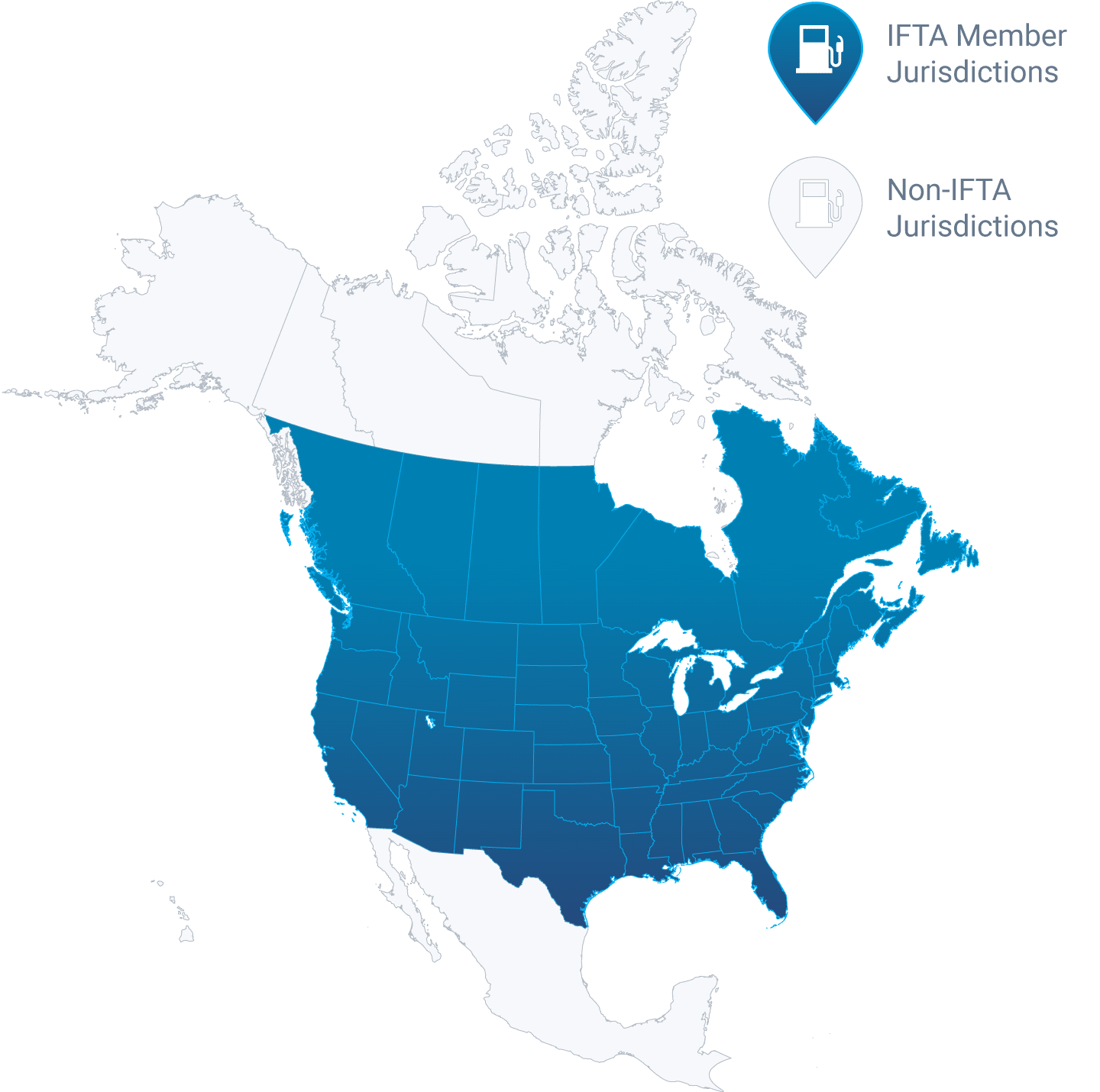

What is the IFTA?

The International Fuel Tax Agreement (IFTA) is a fuel tax collection and sharing agreement among member jurisdictions in the U.S. and Canada for the redistribution of fuel taxes paid by motor carriers. In general, IFTA applies to commercial motor vehicles used for businesses purposes that travel between multiple states and/or provinces.

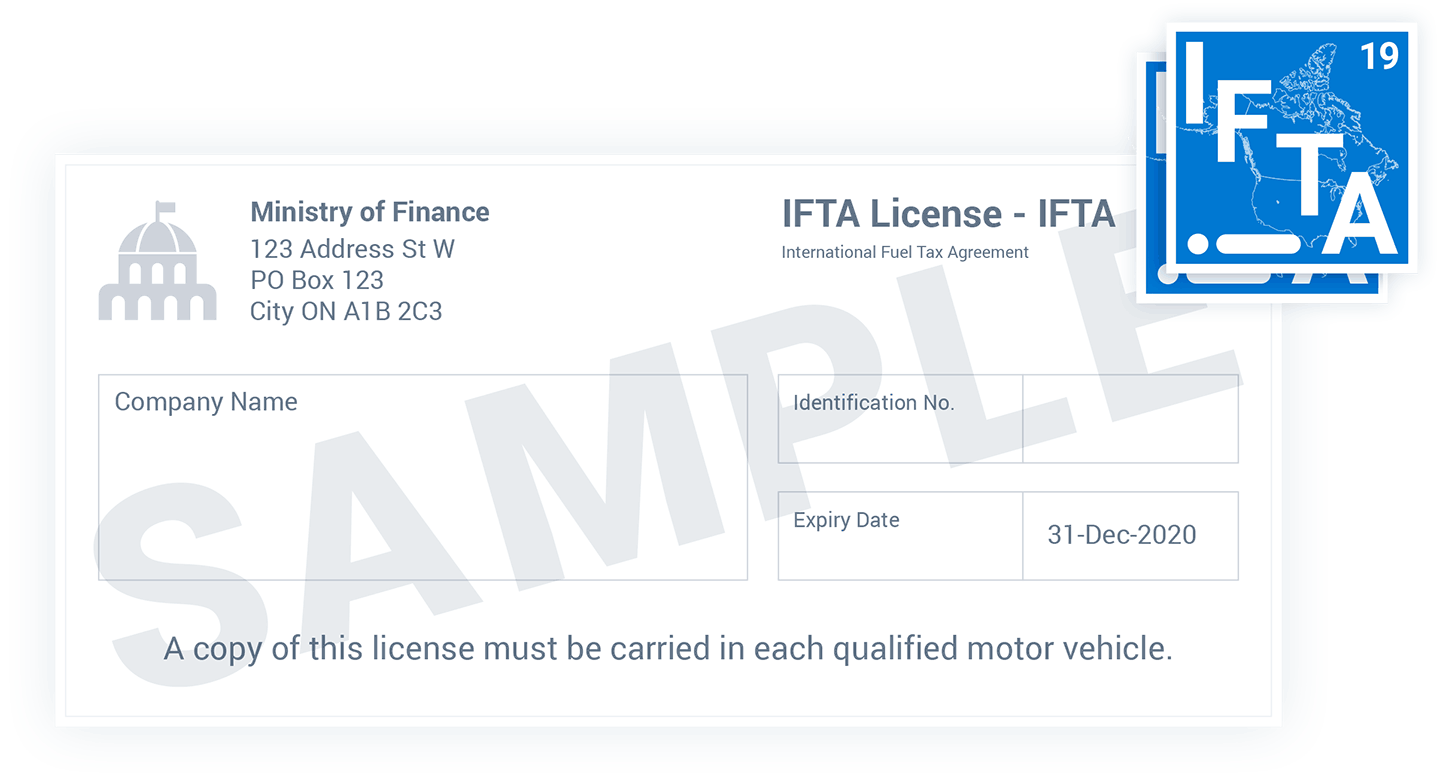

IFTA Licence

Carriers must apply for and obtain an IFTA licence for qualified motor vehicles that travel in more than one IFTA member jurisdiction. Qualified motor vehicles are defined by the IFTA Articles Agreement as motor vehicles which are used, designed or maintained for the transportation of persons or property. Two decals must be added onto each qualified motor vehicle once the IFTA licence is obtained. These decals must be annually renewed.

Simplify IFTA Fuel Tax Reporting

Easily import fuel card data into MyGeotab or configure a partner fuel card integration instead of adding up receipts manually. Fuel transactions will be added to the MyGeotab IFTA report.

Increase Accuracy With IFTA Automation

Reduce the risk of potential issues such as missing paperwork, errors or overpayments. Automated IFTA reporting of mileage with telematics means greater accuracy.

Ready to boost fleet productivity?

Let us show you how simple it is to use our web-based software and fleet tracking devices to improve your fleet productivity.

Driver Tracking

Asset Tracking and Management

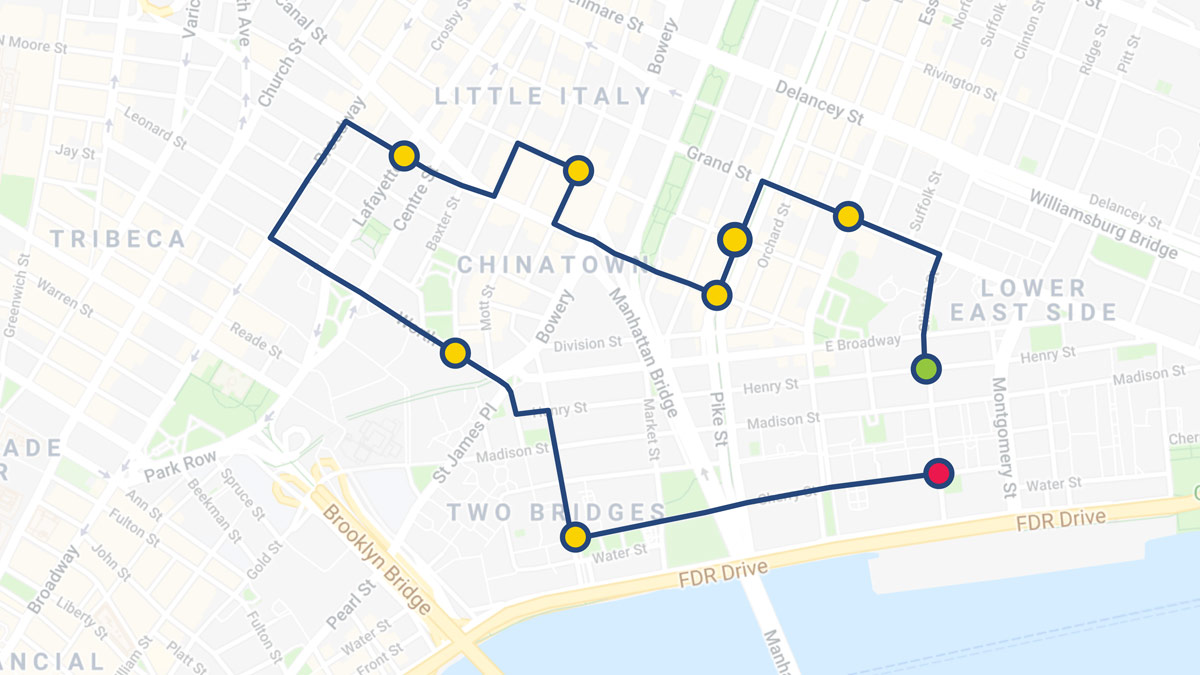

Routing and Dispatching

Fleet Management Reports

Schedule a Free Consultation

Need a customized fleet solution? Want to see the software in action and learn how it will work for your fleet? Schedule a free consultation to learn how Systems & Telematic Solutions can help your company decrease costs while increasing safety and efficiency. Book now!